Autumn 2024 UK Property Market Report: Growing market momentum

Posted on: Monday, September 9, 2024

With a more positive outlook for autumn, confidence should continue to return to the housing market, as inflation remains under control and interest rates are now taking their first steps downwards.

Setting the scene

The property market has remained active, if a little subdued, over the summer. However, the first bank rate cut in four years, along with subsequent accelerated mortgage rate drops, has resulted in a boost to buyer activity, providing a more solid foundation for the potential for stronger sales as we enter the colder months. The number of potential buyers contacting estate agents about homes for sale has increased from 11% year-on-year in July to 19% since the start of August (Rightmove). Increased political certainty and an improved economic outlook has also contributed to improving housing market sentiment.

Solid activity

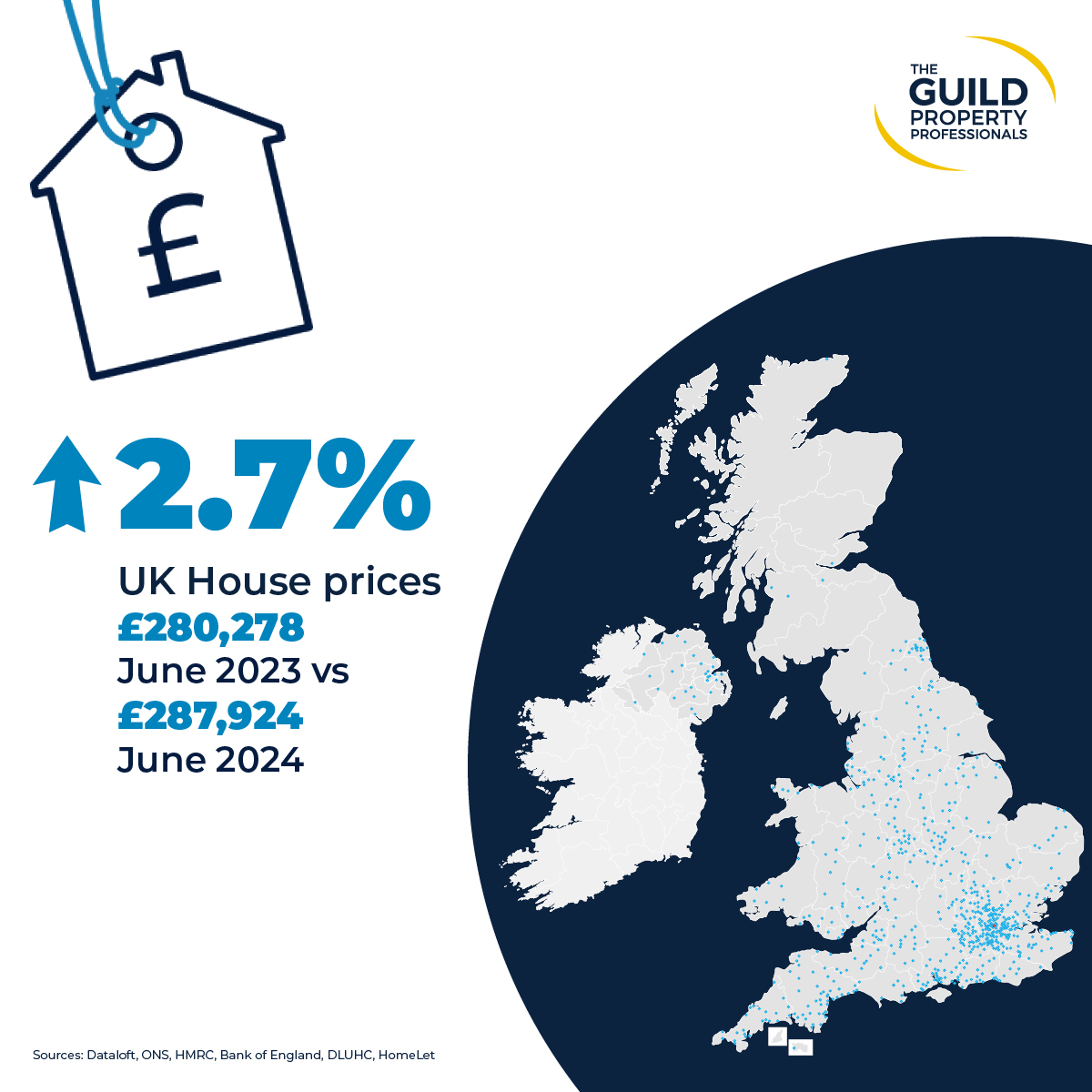

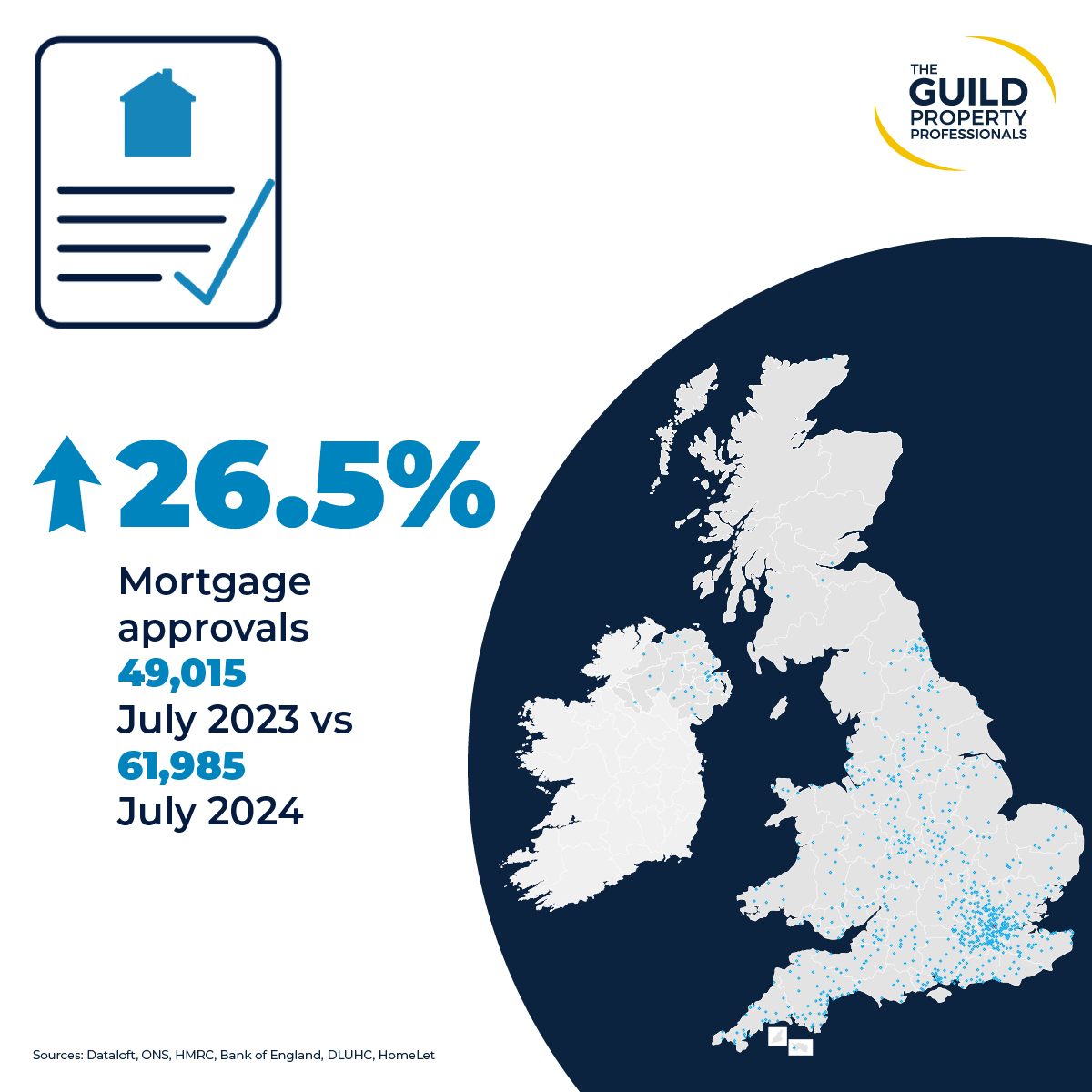

The housing market has proved resilient and fared better than many expected at the start of the year. Despite the added dynamic of the General Election, consumer confidence remains buoyant. Mortgage approvals for house purchases in the UK reached 62,000 in July, their highest level in almost two years. This represents a 2.3% increase from the previous month and a 26% rise compared to a year ago (Bank of England). With improving sentiment, the latest consensus forecast predicts 2.2% house price change through 2024, up from a 2024 forecast of -2.2% at this time last year (HM Treasury Average of Independent Forecasts).

Transactions building

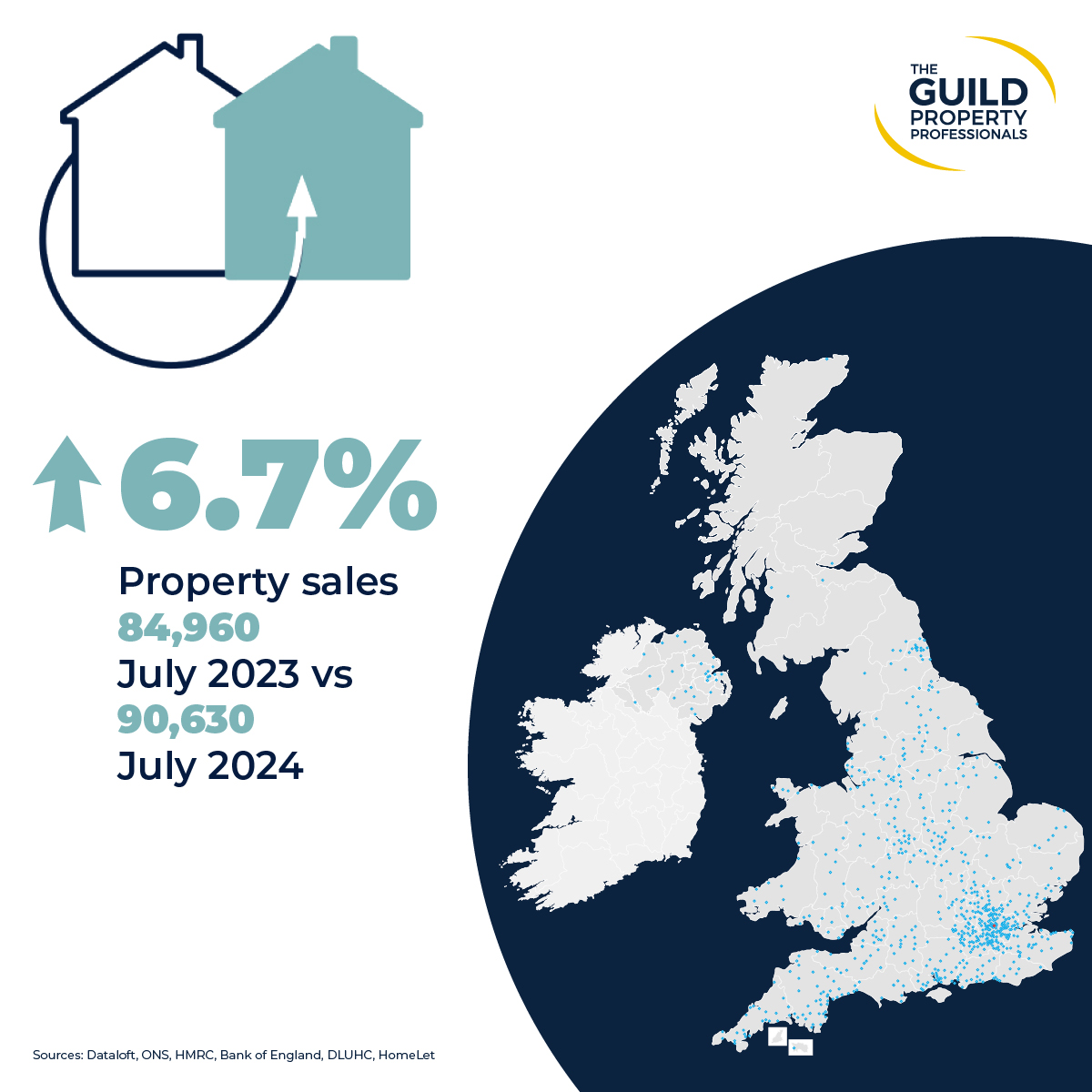

Stable prices offer welcome increased certainty to buyers and sellers, in this context there is an expectation that transaction activity will increase. Transaction levels in July were 6.7% higher than a year ago (HMRC). Markets are pricing in a further interest rate cut this year, meaning transaction volumes are expected to be stronger than autumn last year. Almost a third (32%) of agents say transaction levels are higher than three months ago (Dataloft by PriceHubble (Poll of Subscribers)). In line with this sentiment, expectations for sales volume for the next three months have reached their most upbeat level since January 2020 (RICS).

Lettings

This time of year is typically very busy for the lettings market and competition remains strong. Letting agents are receiving 17 enquiries for every rental property, over double the 8 this time in 2019 (Rightmove). However, affordability is becoming increasingly stretched and rental growth is showing signs of moderating from the unsustainable highs over the last few years. Rents grew 5.2% annually in July, almost halved from 10.3% a year ago (HomeLet).

The government has confirmed plans to require all rented properties in England to have a minimum EPC rating of C by 2030. Over the past 12 months, only 56% of rental properties met this standard, a third of lets were in homes with a D rating, while 10% were E or below (Dataloft Rental Market Analytics, MHCLG).

Regional Reports

Browse our Regional Market Reports:

Property Market Update Autumn 2024: Southern Home Counties

Property Market Update Autumn 2024: North East, Yorkshire and the Humber

Property Market Update Autumn 2024: Essex, Norfolk and Suffolk

Property Market Update Autumn 2024: Herts, Beds and Cambridgeshire

Property Market Update Autumn 2024: Devon and Cornwall

Property Market Update Autumn 2024: North West

Property Market Update Autumn 2024: Northern Ireland

Property Market Update Autumn 2024: London

Property Market Update Autumn 2024: Thames Valley, Berkshire, Oxfordshire, Buckinghamshire

Property Market Update Autumn 2024: Scotland

Property Market Update Autumn 2024: Wales

Property Market Update Autumn 2024: South East Home Counties, Kent and East Sussex

Property Market Update Autumn 2024: West Midlands

Property Market Update Autumn 2024: West of England

Property Market Update Autumn 2024: East Midlands

Property Market Update Autumn 2024: Southern

Contact us

Sell your property with your local expert this autumn. Contact your local Guild Member today.

Recent News

Spring 2025 UK Property Market Report: Solid Start

Read More

Regional Property Market Update Spring 2025: Wales

Read More

Regional Property Market Update Spring 2025: London

Read MoreRead What Our

Customers Say